Interest lobbying under the guise of concern for business — what will be the consequences of taxation of international parcels

Notorious supporter of the concept “in order for a cow to eat less and give more milk, it needs to be fed less and milked more” “Servant of the People” Danylo Hetmantsev, under the guise of “business requirements”, registered a draft law on the collection of VAT on all foreign purchases, regardless of their value. In other words, every Ukrainian, buying goods of any value and purpose abroad, when sending them to Ukraine, will have to pay an additional fifth part, or 20% of the cost of the goods.

What is the situation with international parcels now?

Currently, all international postal shipments from foreign stores are exempt from VAT if their value does not exceed €150. If it is more, then you pay VAT on the difference between the actual price and the threshold amount. For example, when purchasing Nike sneakers for €95 from online store, you do not pay VAT. However, if the cost of your sneakers is €160 (the price + domestic shipping costs, if shipping is not included), you pay a 10% customs duty on the difference between the threshold amount (€150) and the actual price, which amounts to €1. You also pay 20% VAT on the difference—€10 + the customs duty (€1), meaning the total cost of this purchase will be €163 + shipping to Ukraine.

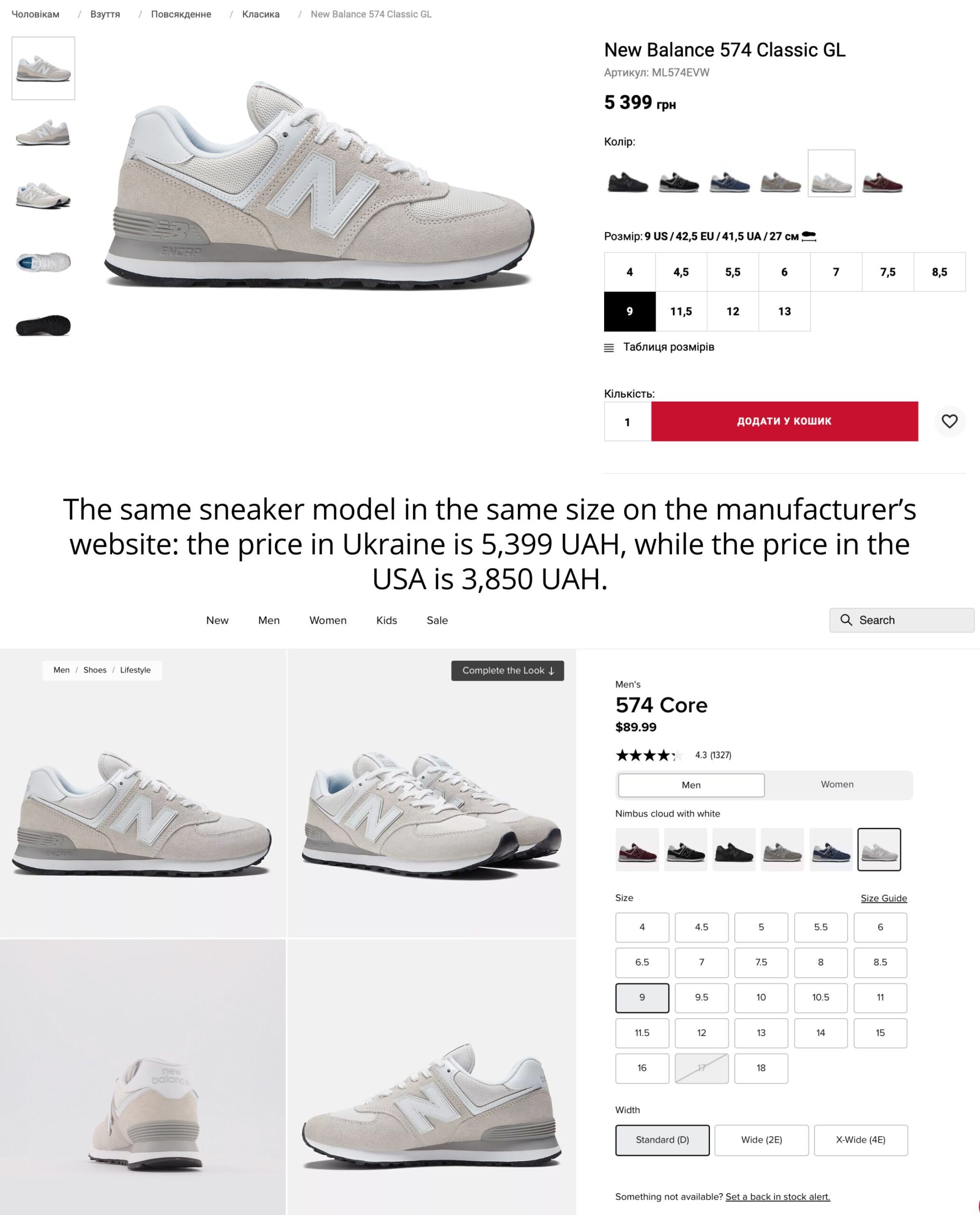

This makes online shopping abroad profitable for Ukrainians. For example, the difference between the price of the same model of sneakers even on the manufacturer’s website is about 1,500 UAH. Even taking into account delivery, the cost of which will vary from $7 to $18 (faster and more expensive by plane, longer and cheaper by sea), the difference will still be about 1,000 UAH. If you add to this a much larger number of promotions and sales, access to the latest models and a much larger range of products — the popularity of cross-border shopping will become obvious.

Ukrainians have less money for purchases that are not critically necessary. The increase in the cost of housing, utilities, products, and medicine leaves fewer opportunities to buy clothes, appliances, and other goods that are usually not needed immediately, but cannot be dispensed with.

In addition to ordinary household needs, international purchases cover another important need — for military equipment. The latter, like almost all parts for drones, are bought abroad privately, since at the end of the third year of a full-scale war, the state does not cover all the needs of military personnel — specific, destroyed or just high-quality equipment is bought for their own money and donations, drones are assembled in kitchens and garages, ready-made ones are bought abroad. The above example with sneakers works the same way with military goods.

What does the government offer instead?

Deputy Hetmantsev registered a draft law with the idea to charge VAT in general on all purchases in online stores that are sent to Ukraine by mail, and to exempt from taxation only those goods that are sent by individuals to the address of individuals, without payment and without a commercial purpose, and are valued at up to €45. At the same time, Hetmantsev suggests to transfer the obligation to declare and pay VAT to the seller or carrier (postal operator).

Let’s analyze the phrase of the author of the draft law, which clearly demonstrates the manipulative nature of the whole idea: “Payment of VAT by the supplier of the goods or the marketplace will eliminate the need for additional customs payments by the buyer“. But it is clear that if VAT is paid not by the buyer during customs clearance, but by the seller during the sale — this will not exempt the buyer from additional payments, it will simply increase the price of the goods for the buyer by the amount of these payments + the cost of operating costs for their administration by the seller or carrier.

Therefore, under the new law, €95 sneakers will cost you €114 + shipping, and €160 sneakers will cost you €192 (+ shipping). And this is because it is proposed to transfer the task of declaring the value of goods to carriers and postal operators; consequently, this will increase their operating costs and lead to higher prices for services.

Danylo Hetmantsev motivates his proposal by the fact that Ukrainians too often use the duty-free value limit in order to import a large number of goods for further resale in Ukraine without paying VAT. And it causes losses to the state and business (allegedly, Hetmantsev registered his initiative at the request of business).

There is indeed a problem with exceeding the duty-free limit; and this is not only a Ukrainian problem, it is also relevant for the EU, where the duty-free limit was only €22 (half the limit proposed by Hetmantsev for duty-free sending from an individual to an individual), as well as for the USA, where it is much higher — $800.

According to the Institute of Socio-Economic Transformation, in 2024 additional VAT revenues in the case of cancellation of tax relief for parcels worth up to 150 euros, could amount to 11.8 billion UAH.

Where is the problem?

In the same study of the Institute of Socio-Economic Transformation, it is written that volumes of potential contraband and gray imports in 2023 were in the range 380–540 billion UAH, and the state budget lost 120–167 billion UAH within a year from customs schemes. It is not difficult to notice that the entire projected volume of taxes from international parcels is 10 times smaller than budget losses from violation of customs rules.

In other words, a decision that will cause harm to Ukrainians in a difficult economic situation, which will make goods for the military even more expensive, which will cause harm to operators of the postal market (Ukraine Express, Nova Poshta, Meest, Ukrposhta, DHL, etc.) — will bring only a tenth of the income to the budget, which it loses annually due to inefficient work of state institutions, primarily customs.

On the other hand, the already mentioned study of the Institute of Socio-Economic Transformation contains information that one person, receiving one postal item per day, can import goods worth up to 4.5 thousand euros per month (€149 * 30 days), without paying taxes. 100 such persons (actually – 100 passports), who will receive 3 items per day, can import goods worth 1.34 million euros per month without paying taxes. The Institute notes that this is already a large batch of goods, which can then be sold in stores, in the same way as legally imported goods.

However, if the customs office is unable to control the flow of parcels up to 150 euros, it will also not be able to control the flow of parcels up to €45 (threshold of duty-free sending between individuals). As a result, this draft law will make household purchases abroad more expensive, will increase the expenses of the military and volunteers, will not solve the problem with tax evasion and will not eliminate schemes with gray imports.

On the contrary – if carriers are obliged to open each parcel to determine its real value and further customs clearance, then the burden on both carriers and customs will increase significantly. Consequently, customs will be even more unable to detect really large volumes of contraband — due to the government’s desire to make money on children’s overalls which cost 50 euros.

Hetmantsev’s draft law will really help retail, large retail chains, because for Ukrainians, the costs of shopping abroad will increase to the prices in retail chains,

which will increase the income of the latter. However, increasing the income of big business, reducing the general purchasing power of citizens — it’s not taking care of business, it is lobbying for the interests of a small part of it.

In one of the interviews, Danylo Hetmantsev called himself “a professional in making unpopular decisions.” But not every unpopular decision is automatically good or necessary. Often an unpopular decision is simply a bad decision. And in this matter Hetmantsev is an expert.

What should be done?

Firstly, create a system for collecting and analyzing data on volumes, dynamics, and routes of movement of international parcels. This will make it possible to distinguish law-abiding buyers from participants in tax evasion schemes, who (allegedly under the guise of household purchases) import consignments of goods for resale. And if the average number of such items to one buyer does not exceed 5-10 per month (or even less), then those who get 5 every day can already be taken under consideration. This is not a difficult task, because customs and postal operators already have all the necessary data.

Secondly, focus on eliminating smuggling and corrupt import schemes at customs, digitize customs procedures and ensure the exchange and transparency of customs data.

As it was mentioned, this would bring more money to the budget than trying to tax every pair of pants and socks purchased directly from the manufacturer.

Thirdly, develop a differentiated approach to customs benefits for individual purchases. Instead of the same benefit for any goods up to 150 euros, imported from any country in the world, it is necessary to introduce sectoral benefits, focusing on the interests of the state and the Ukrainian producer in critical sectors of the economy (not household retail).

It is necessary to increase the duty-free limit for goods for the military, drones, spare parts for them, electronics and equipment (the production of which is absent in Ukraine and is not expected in the nearest future). To reduce this limit for those goods that are produced in Ukraine. Increase the duty-free limit for goods from the EU and the USA – and reduce it for goods from China (excluding the mentioned drones, parts for them and similar goods — until the replacement for Chinese goods is found). Ukraine and Ukrainians are most interested in connecting our and allied markets to such an extent that any idea of severing these ties is unacceptable.

Insisting on strengthening control over the purchases of Ukrainians, the author and supporters of the draft law also appeal to experience and regulations in the EU. However, in the EU, in addition to regulations, there is also a huge domestic market that can satisfy much more household needs than the domestic Ukrainian market. In addition, EU representatives do not insist that Ukraine harmonize this aspect of the legislation with EU norms right now.

We will have to do it, but no one forbids us to postpone this problem until the end of the war and the accession of Ukraine to the European market. The fact that Ukrainian retail will not be able to set the current markup level in such conditions is by no means a reason to make life difficult for everyone else right now.

Traditionally, the Ukrainian authorities have decided to choose a simple way and collect money from Ukrainians where it can be done immediately and without difficulties.

Such a decision could even be understood in the conditions of war, if at the same time the same government did not spend billions of hryvnias in populist attempts to maintain political ratings by financing the oligarchic channels of the United Marathon (for the same purpose) and the companies of related persons, and simply delaying the adoption of long-overdue decisions (probably for corrupt purposes).

Military serviceman of the International Legion for the Defense of Ukraine with the call sign “Paradox” is the crew commander of the American M113 armored personnel carrier. He is a master at using it and is constantly improving, because the legionnaire’s skills are tested every day in battle. You have to drive to the front lines, often under artillery fire and drone attacks.

Notorious supporter of the concept “in order for a cow to eat less and give more milk, it needs to be fed less and milked more” “Servant of the People” Danylo Hetmantsev, under the guise of “business requirements”, registered a draft law on the collection of VAT on all foreign purchases, regardless of their value. In other words, every Ukrainian, buying goods of any value and purpose abroad, when sending them to Ukraine, will have to pay an additional fifth part, or 20% of the cost of the goods.

When Russian missiles began barraging Ukrainian cities in the first moments of the full-scale invasion,…

On the last Saturday of November, Ukraine commemorates the victims of the Holodomor of 1932–1933…

By Vladyslava Chorna, Bukvy Editor-in-Chief Otar Dovzhenko, a media researcher, creative director of the Lviv…